Here I present an overview of the

government budget of the Kingdom of the Netherlands between 1950 and the

present. Samples have been taken approximately every 5 years and after 2002

every year. I show that purchasing power of the total budget peeked in the late

90’s and after 2000 dropped down to pre 90’s levels. Furthermore, we observe a

shift in funds being diverted from the Defence, Public debt and Finance right

after the second World War; to Education, Defence and Infrastructure in the

70’s; to Housing, Public debt and Education in the 90’s; and to Health care,

Social security, and Education in more recent years. (Please excuse my lack of

jargon and the correct terminology as economics is not my field).

Total budget growth

Since the Second World War the economy of the Kingdom of the Netherlands

has grown tremendously. In particular the 1950’s and to a lesser extend the

1960’s were characterized by a high growth rate.[1] This growth declined in the 1970’s and 1980’s

to be partially restored in the 1990’s. [1] Contrary to this economic growth, the total

size of the budget has been growing slowly during the 1950’s and 1960’s but has

been growing significantly faster during the 1970’s and the 1980’s, and lagging

during the 1990’s (Figure 1).

Figure 1: Growth of the

government budget since the 1950 as obtained from the Statistics Agency of the

Netherlands. The amount is converted to Euro’s from guilders but not inflation

corrected. Note the quicker growth in the 70s and 80’s, which is repeated after

2007. The thin line is a moving average using 2 intervals.

Yet these figures were used as is and not corrected for inflation, so

the next logical step would be to couple them to a form of purchasing power

before we can draw any conclusion.

Purchasing power of the

government budget

Unfortunately I was able to obtain inflation corrected figures, hence I

was forced to improvise. In order to convert these figures to values

representing some form of purchasing power, I used the following metrics: Price

of crude oil (dollar, 1950 – present),[2] price of gold (dollar, 1950 – present),[3] price Maize (dollar, 1985 – present),[4] price of commodity metals (dollar, 1985 –

present),[5] and naturally the dollar – guilder and dollar

– euro exchange rates.[6-8] These were chosen to represent heating (oil),

food (maize) and raw materials (gold and steel). Inclusion of more commodities

would lead to more reliable results but was not doable for this post (yet

people are welcome to use my figures and expand!).

The procedure described above allowed me to normalize the figures and

create a more reliable image (Figure 2). For Figure 2A the budget size was

expressed as ounces of gold this budget could buy as well as barrels of crude

oil. Those two ranges were normalized between 0 and 1 over the time period

1950-2013 and the average of the two metrics was used to create figure 2A.

Similarly for Figure 2B the budget was expressed in ounces of gold, barrels of

oil, tons of maize and tons of metal (a composite index value), subsequently

these values were normalized over the period 1985-2013. We now observe that

while the absolute value of the budget grew quicker during the 1970’s and

1980’s, the commodity price caught up leading to a lower absolute purchasing

power (likely caused by the steep rise in oil price and the decoupling of the

dollar from gold). Moreover, we see that the total budget value (here expressed

as purchasing power) actually declines rapidly after the peak of 2000. The

absolute value in 2013 declines to pre 1990 values (interpolated as I have not

received the 1990 government budget from the Statistics agency).

Figure 2: Budget size expressed

as an index value representing commodities the total budget value can buy. We

now observe that, while the absolute value of the budget grew quicker during

the 1970’s and 1980’s, the commodity price caught up leading to a lower

absolute purchasing power. However, we also observe that in more recent years

the commodity prices have grown so fast, the total purchasing power of the

budget has actually declined to pre 1990’s

levels.

Development of the budget 1950 –

2013

Over the mentioned time period I wanted to see how the budget developed.

What costs declined over time and what costs did rise. Can we rationalize the

changes (coming from the zeitgeist)? To do this, I have calculated the

percentage all individual expense categories makeup of the total budget. While

this is not perfect, it should give an idea of prioritization and choices made

in the past. However, a large number of different budgetary items have been

introduced and removed over the years. Hence I more or less standardized this

by using the categories as they are described in Table 1. It should be noted

that ‘Inkomsten en Uitgaven Collectieve Sector’, which contained most social

security costs upto 2009, was unavailable to me. These numbers were not

provided by the statistics agency and I invite people who DO have these numbers

to append to this work (the excel is available as a download).

Table 1: Used standardized

budgetary items.

Budgetary Item

|

General affairs and house of the Queen

|

Social Security

|

Public Health

|

Education/Culture

|

Public Debt Interest

|

Municipalities and

Provinces

|

Foreign Affairs

|

Infrastructure

|

Defence

|

Finance

|

Justice

|

Home Affairs

|

Economic Affairs

|

Agriculture

|

Housing

|

Balkenende Item (Youth and integration) *

|

Mixed Balkenende Items

*

|

Other *

|

Subtotal

|

Deficit *

|

Debt reduction *

|

Total

|

Items marked with an asterisk are

only used when applicable.

Budgetary items reduced on

average (1950 – 2013)

Let’s first examine the public debt interest costs (Figure 3). Very high

right after World War 2 this figure declined quickly in the immediate post war

era. However during the early 1980s recession, declined again and really peaked

in the early 2000s.

Figure 3: Total public debt as a

fraction of the total government budget. Declining after the Second World War,

rose in the 80s recession and the early 2000s. While the total public debt rose

over the last years, the actual interest resulting from the loans decreased.

While it is often considered a good thing to keep the burden of public

debt interest as low as possible, there are other budgetary items that have

been reduced over the years as shown in Figure 4.

Figure 4: Budgetary items that

have been reduced over the period between 1950 and the present. While it is

understandable that defense expenses have been reduced greatly after wartime

levels, it can be stated that reducing them to about 2-3 % of the total might be

another extreme. Similarly, it can be argued that infrastructure, something

that the Netherlands are renowned for, should receive ample funding. With

regards to agriculture, it could be argued that these expenses are transferred

to EU budget. The ministry of housing has been absorbed by the ministry of

Economic Affairs.

Budgetary items not showing a

trend (1950 - 2013)

Next to items that show a decrease in spending there are some items that

not show a clear trend. These items can increase or decrease with the zeitgeist

and examples are shown in Figure 5. While most make up a small fraction of the

total, the dominating line represents the money available for education and

culture. Peaking in the 1970s (and likely responsible for the current educated

professionals in society) is has been on the decrease over the last years. This

could be considered a short sighted approach as the investments made in the

1970’s are still paying off today.

Figure 5: Budgetary items showing

no clear trend, increasing or decreasing with individual governments. However

it can be seen that education / culture has always made up a significant

fraction of the total budget whereas justice has made up a significantly

smaller fraction.

Budgetary items rising on average

(1950 – 2013)

This brings us to the final section, budgetary items making up a much

large fraction of the budget over time. Not surprising this includes social

security and public health. However it is noteworthy that the reforms of 2006

have not done much to decline the health spending growth. Both items are

responsible for half of the total budget every year since 2010!

Furthermore, the provinces and municipalities are the 4th largest

item on the budget, rising steadily over the years (Figure 6). According to Wikipedia the Netherlands went from 24th worldwide (when healthcare is expressed as % of the total) in 2008 to 2nd in 2010 ! (right after the US) See also the

figures at Worldbank.[9]

Figure 6: Budgetary items growing

as a fraction of the total over the period 1050 – 2013. While health costs and

social security costs are expected to rise due to the ageing population, it

could be considered that a 60 % cut of the total budget might be somewhat

extreme.

Conclusion

Here I tried

to organize and some figures about the Dutch government budget. While my

overview is crude at best it serves to illustrate a shift in government

spending. We observe clearly some high impact events like the fallout of the Second

World War, the 1970’s energy crisis and initiation of the welfare state; the 80’s

recession; the 90’s bubble and the recent crisis. Some general observations could

be considered reason for change. The most important being the appearance that

education, infrastructure and defense are being systematically sacrificed in

favor of social security and health care. On the short term this might seem

reasonable, but this could have some nasty long term consequences.

Needed follow up

What I have shown here is in need of a

follow up.

- The numbers should be recalculated using the

proper inflation corrected figures.

- Furthermore the 'Collectieve sector' should be

included as far back as applicable.

- Moreover the missing samples (1990, 1980) should

be included.

Interesting other possible calculations could be:

- Calculations of the size of the government budget

as a fraction of GDP (inflation corrected).

- Amount of people (e.g. police officers) that

could be hired as a result of the changing budget.

- Total size of the government budget expressed in

times the average salary (or average people that can be hired.

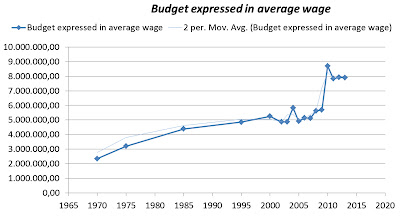

A preliminary plot is here, when we divide the total budget by the

height of the average wage as obtained from GemiddeldInkomen.nl.[10] We get an approximation of the number of people that

can be hired through the total budget. Interestingly this rises slowly (but

steadily) from 2.000.000 in 1970 (earlier figures were not at my disposal) to

5.000.000 in 2008, to 8.000.000 (at 33.000 euro's average wage) in 2010!! That

is a significant fraction of the population. This could indicate that (1)

average wage is relatively low (has risen very slowly contrary to government

buget), (2) government budget has grown out of proportion with people income

(which could be indicating that taxes rise out of proportion, Figure 7).

Figure 7: Government budget divided by the

average wage as an indicator of how many personnel the government could higer

and hence the relative government size. Note the steep growth post 2010 / post

crisis following a relatively stable period.

Naturally this analysis should be redone

using the proper number of people employed, it could also be (option 3) that

those people employed just started to make significantly more money than

average wage....

Please find the excel form I used here feel free to build or debunk my figures!

References

2. Crude Oil Price [http://inflationdata.com/Inflation/Inflation_Rate/Historical_Oil_Prices_Table.asp]

6. Historic Dutch Guilde Exchange Rate [http://en.unciatrends.com/us-dollar-dutch-guilder-usd-nlg-exchange-rate-1971-2001/]